In recent years, the finance world has witnessed the remarkable emergence of green bonds as a popular instrument for sustainable investing. Green bonds, designed to fund environmentally beneficial projects, offer investors a unique opportunity to support the transition to a low-carbon economy while earning returns. But what exactly are green bonds, and why are they gaining so much traction?

What Are Green Bonds?

Green bonds are similar to traditional bonds but come with a specific commitment: the funds raised are exclusively allocated to projects that have positive environmental impacts. These projects can range from renewable energy initiatives and energy efficiency upgrades to sustainable agriculture and conservation efforts. The core idea is to provide capital for projects that contribute to environmental sustainability, thus aligning financial interests with ecological goals.

A Brief History

The concept of green bonds originated in 2007 when the European Investment Bank (EIB) issued the first-ever green bond, known as a Climate Awareness Bond. Since then, the market has grown exponentially. The World Bank followed suit, and soon after, corporations, municipalities, and other financial institutions joined the green bond movement. Today, the green bond market is a significant and rapidly expanding segment of the global bond market.

Why Are Green Bonds Important?

- Environmental Impact: Green bonds directly fund projects that mitigate climate change, reduce pollution, and promote sustainable practices. This includes initiatives like wind farms, solar power plants, sustainable water management, and green buildings.

- Investor Demand: There is a growing demand from investors for sustainable investment options. Green bonds offer a way to invest in fixed-income securities while also contributing to environmental sustainability. This demand is driven by increasing awareness of climate change and a desire to support positive environmental outcomes.

- Corporate Responsibility: For companies, issuing green bonds is a way to demonstrate their commitment to environmental responsibility. It enhances their corporate image and can attract a broader base of socially conscious investors.

- Regulatory Support: Governments and regulatory bodies worldwide are increasingly supporting green finance initiatives. Policies and incentives are being developed to encourage the issuance and investment in green bonds, further boosting their appeal.

How Do Green Bonds Work?

Green bonds work much like traditional bonds. An issuer—such as a government, corporation, or financial institution—issues the bond to raise capital for specific green projects. Investors purchase these bonds, providing the necessary funds for the projects. In return, investors receive regular interest payments and, upon maturity, the principal amount is repaid.

The key difference lies in the use of proceeds. Issuers must clearly define and report how the funds will be used, ensuring they go towards environmentally beneficial projects. This transparency is crucial for maintaining investor trust and credibility in the green bond market.

The Benefits for Investors

- Diversification: Green bonds offer an opportunity to diversify investment portfolios while aligning with sustainability goals.

- Competitive Returns: Many green bonds provide returns comparable to traditional bonds, making them financially attractive.

- Impact Investing: Investors can contribute to meaningful environmental projects, making a positive impact on the planet.

- Risk Mitigation: Investing in green bonds can be seen as a hedge against the financial risks associated with climate change, such as regulatory changes and shifting market demands.

Statistics and Market Growth

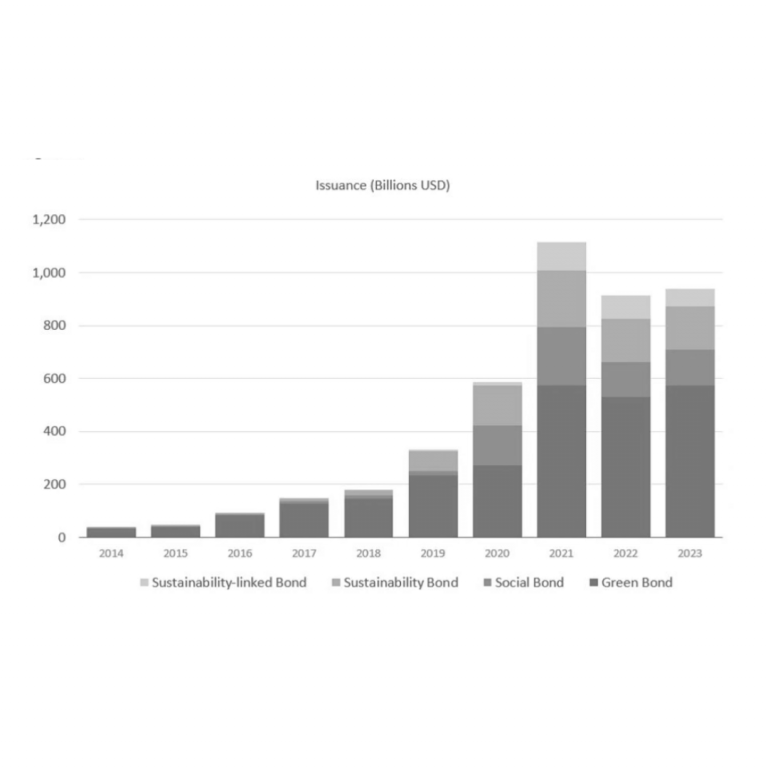

The green bond market has seen impressive growth over the past decade, underscoring its importance and popularity:

Market Size: In 2020, the global green bond market reached a milestone of $1 trillion in cumulative issuance. By 2021, annual green bond issuance hit a record $500 billion, demonstrating the rapid growth and increasing investor interest.

Issuance Growth: The market saw a 13% increase in green bond issuance in 2021 compared to 2020, reflecting a strong and growing demand for sustainable investments.

Diverse Issuers: Green bonds are issued by a wide range of entities, including governments, municipalities, financial institutions, and corporations. In 2021, Europe accounted for nearly 50% of global green bond issuance, followed by North America and Asia-Pacific.

Corporate Participation: In recent years, an increasing number of corporations have entered the green bond market. Major companies like Apple, Toyota, and PepsiCo have issued green bonds to fund their sustainability initiatives.

Investor Base: The green bond market has attracted a diverse range of investors, including institutional investors, pension funds, and retail investors. This broad base underscores the wide appeal and trust in green bonds as a viable investment option.

Challenges and Future Outlook

While the green bond market is growing rapidly, it faces several challenges. One major concern is the need for standardized definitions and reporting frameworks to ensure the integrity and transparency of green bonds. There is also the risk of “greenwashing,” where bonds are marketed as green without meeting stringent environmental criteria.

Despite these challenges, the future of green bonds looks promising. As awareness of climate change continues to rise, so too does the demand for sustainable investment options. With increasing regulatory support and a growing commitment from both issuers and investors, green bonds are poised to play a crucial role in financing the transition to a sustainable future.

Conclusion

Green bonds represent a powerful tool in the fight against climate change, offering a way to channel capital towards environmentally beneficial projects. For investors, they provide a unique opportunity to achieve competitive returns while supporting sustainability. As the green bond market continues to evolve, it holds the promise of driving significant environmental and economic benefits, paving the way for a greener, more sustainable future.

Investing in green bonds is not just a financial decision—it’s a commitment to the health of our planet and the well-being of future generations. So, whether you’re an investor, a corporate issuer, or simply someone interested in sustainable finance, green bonds are a topic worth exploring.

BM Intelligence - providing tailor-made corporate consulting and financial services to both companies and individual clients.